FINANCIAL WELLNESS

Financial Wellness is your satisfaction with your current and future financial situations. With financial wellness it is important to focus on learning how to successfully manage expenses for both the short (while you’re in college) and long term (as you move into your future careers) and living within your means. It includes things such as budgeting, financial literacy, income, debt, savings, and understanding of resources.

“The feeling of having financial security and financial freedom of choice, in the present and when considering the future.”

- Financial Wellness as described by the U.S Consumer Financial Protection Bureau

Finances are an issue for 45.5% of UF students and it causes moderate or high distress for 79.2% of those students as reported by NCHA (2022) data. Let’s take a deeper look into how financial wellness is part of our wellness over, being more aware of our spending, and how that plays into the future.

FINANCIAL WELLNESS IS WELLNESS

Not only is Financial Wellness an important part of your overall wellness, but it is one of GatorWells’s Dimensions of Wellbeing. Overall wellness involves more than your physical and mental health and matters in college, as well as after. The Dimensions of Wellbeing are related and often build off each-other. When we worry about money like the amount of loans to take out, this does not just fall into the category of financial wellness. It may cause us to worry, creating anxiety or stress, that relates to emotional wellness. While trying to save money you might eat food with less nutritional value (physical wellness) or say no to doing certain activities with friends (social wellness).

Especially as students, it is important to remember that financial wellness is not about how much money you have, but your satisfaction with your current financial situation with considering living within your means and your future career, income, and expenses.

Areas that students can focus on that relate to their financial wellness are:

- Budgeting

- Work/income

- Checking/savings accounts

- Debt/loans

- Career/future income & costs

SPENDING AWARENESS: WHERE DOES THE MONEY GO?

Why budget your money? 53% of Americans consider budgeting to be the most important money skill that should be taught in schools but currently isn’t, according to an Annuity.org study (this second most important was ‘how to manage debt’ (13%)). Creating a budget is vital to personal finances and with increasing awareness, can be easy to create. The tricky part is sticky to it.

What exactly is budgeting? It's a proactive approach to organizing your finances. Budgeting ensures you're not spending more than you're making, allowing you to plan for short- and long-term expenses. Budgeting is important for your financial stability, ensuring you can pay common expenses like rent, tuition, student loans, credit card bills, and entertainment. There are many different methods of budgeting, including the use of free online resources and apps. An example of an online resource includes these tools and calculators provided by Navy Federal Credit Union. It is important to find a system that works for you because it will help you stick with it.

CAREER OUTLOOK: FOCUS ON YOUR FINANCES

Part of being financially “well” is being satisfied with our financial situation for the future. This includes decisions we are making now like the type and amount of loans as well as career decisions.

When making financial decisions, it is important to consider the future. For example, when taking out a loan, think not just about the amount of money received now, but about the payments in the future and how they relate to your future income.

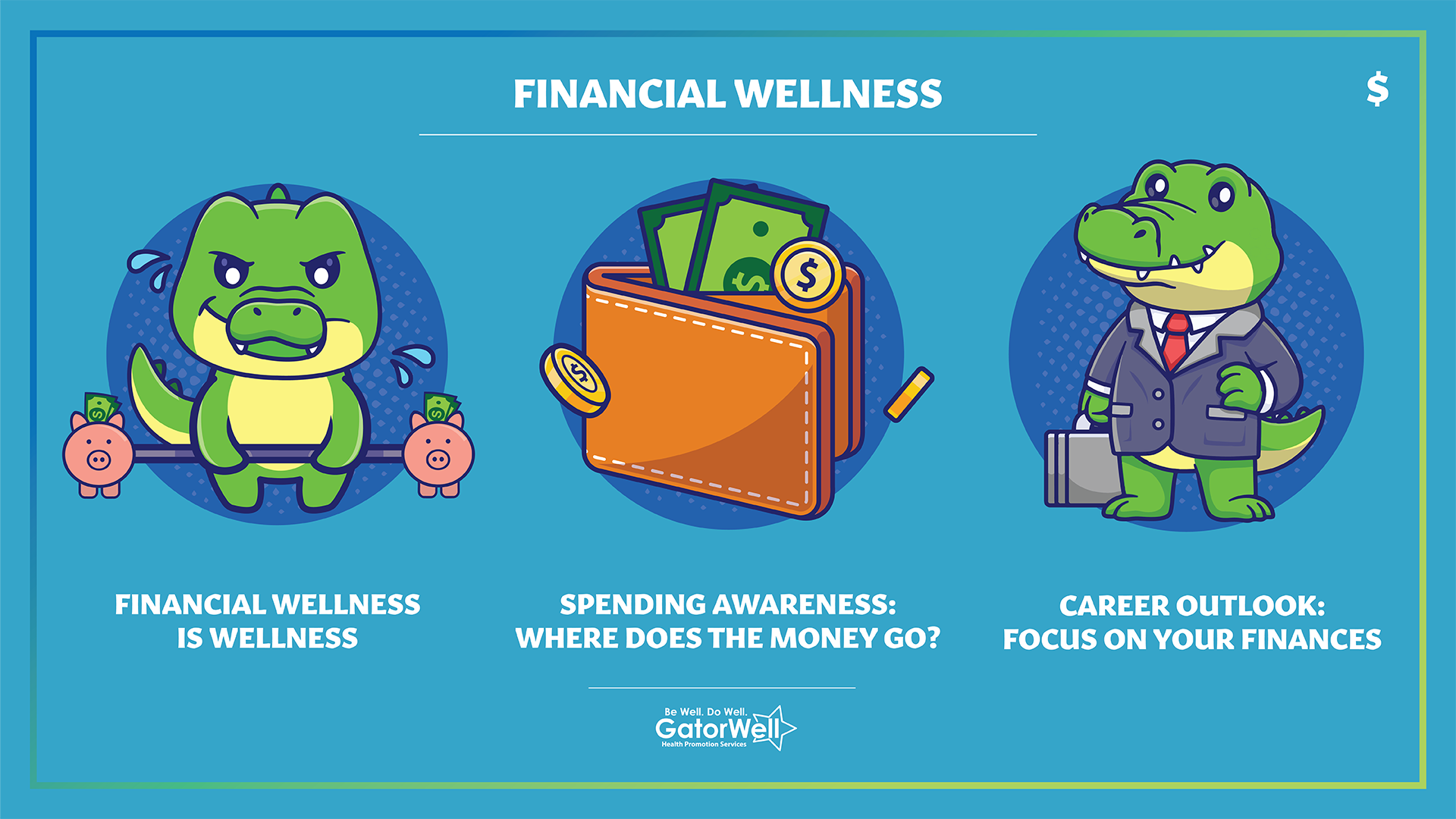

Focusing on your finances can help to reduce financial stress now and in the future. As seen in the four elements of financial wellness below, financial security and freedom of choice relate to both now and in the future. Financial security is not just about a feeling of control in the present moment, but being prepared for unexpected expenses that come up like a car repair or moving expenses as you start your career. Freedom of choice to meet your long-term financial goals is not just about saving or the amount of income associated with your future career but thinking how decisions you make now may relate to your finances in the long-term such as cost of housing and future loan expenses compared to income.

FOUR ELEMENTS OF FINANCIAL WELLNESS

When talking about financial wellness both now and in the future, employment and career outlook often come up. The dimensions of financial wellness and occupational wellness can be very intertwined. When thinking about your future career/occupation, it is important to think about how your satisfaction your work relates to your wellness wholistically, including financially, but also emotionally, physically, socially, and more.